How Much Social Security Will I Get At Age 63?

The amount of Social Security benefits you will receive at age 63 depends on several factors, including your lifetime earnings, the age you start receiving benefits, and whether you continue to work after you start receiving benefits.

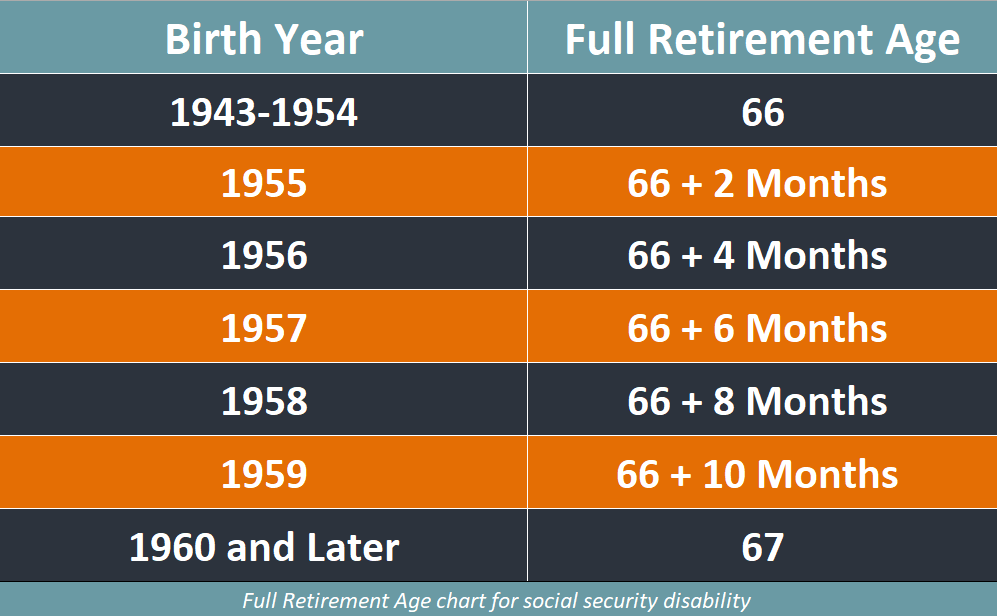

If you start receiving Social Security benefits at age 63, your benefit amount will be reduced from what you would receive if you waited until your full retirement age (FRA) to start benefits. FRA varies based on your birth year, but for people born between 1943 and 1954, it is 66.

Assuming your FRA is 66, and you start receiving benefits at age 63, your benefit amount will be reduced by about 20%. For example, if your full benefit amount at FRA is $2,000 per month, your benefit amount at age 63 would be about $1,600 per month.

It’s important to note that the reduction is permanent and will continue for the rest of your life. Additionally, if you continue to work and earn more than the Social Security earnings limit, your benefit amount may be further reduced.

The best way to get an accurate estimate of your Social Security benefit amount is to create a my Social Security account on the Social Security Administration website or consult with a financial advisor.

Full Retirement Age And How Does It Affect My Benefit At Age 63

Full retirement age (FRA) is the age at which you can start receiving your full Social Security retirement benefits. FRA is determined by your birth year, and it ranges from 66 to 67 years old for those born in 1943 or later.

If you choose to start receiving Social Security retirement benefits at age 63, your benefit amount will be reduced from what you would receive if you waited until your FRA to start benefits. The reduction is based on the number of months between the age at which you start receiving benefits and your FRA.

If your FRA is 66 and you start receiving benefits at age 63, your benefit amount will be reduced by about 20%. For example, if your full benefit amount at FRA is $2,000 per month, your benefit amount at age 63 would be about $1,600 per month.

It’s important to note that the reduction is permanent and will continue for the rest of your life. Additionally, if you continue to work and earn more than the Social Security earnings limit, your benefit amount may be further reduced.

On the other hand, if you wait until after your FRA to start receiving benefits, your benefit amount will be increased by a certain percentage, up to a maximum at age 70. Therefore, if you can afford to delay receiving benefits until after your FRA, you may receive a higher monthly benefit amount.

How Exactly Does Early Retirement Reduce My Social Security Benefit?

If you choose to start receiving Social Security retirement benefits before your full retirement age (FRA), your benefit amount will be reduced from what you would receive if you waited until your FRA to start benefits.

The reduction is based on the number of months between the age at which you start receiving benefits and your FRA. For example, if your FRA is 66 and you start receiving benefits at age 62, your benefit amount will be reduced by 30%.

The reduction is permanent and will continue for the rest of your life. This means that your monthly benefit amount will be lower than it would have been if you had waited until your FRA to start receiving benefits.

The reason for the reduction is that Social Security retirement benefits are designed to be actuarially neutral, meaning that the total lifetime benefits you receive are roughly the same whether you start receiving benefits early, at your FRA, or later.

By starting benefits early, you are receiving benefits for a longer period of time, but at a reduced rate. This is intended to offset the fact that you will receive benefits for a longer period of time.

It’s important to note that if you continue to work and earn more than the Social Security earnings limit, your benefit amount may be further reduced. Additionally, if you start receiving benefits before your FRA and continue to work, your benefits may be subject to the retirement earnings test. Under this test, your benefits will be reduced by $1 for every $2 you earn above a certain threshold until the year you reach your FRA.

How Is My Social Security Benefit Determined?

Your Social Security retirement benefit is determined by your lifetime earnings, the age at which you start receiving benefits, and your work history.

To calculate your benefit amount, the Social Security Administration (SSA) takes your highest 35 years of earnings (adjusted for inflation) and calculates an average indexed monthly earnings (AIME) figure. The AIME is then used to calculate your primary insurance amount (PIA), which is the benefit amount you would receive if you start receiving benefits at your full retirement age (FRA).

Your FRA is determined by your birth year, and it ranges from 66 to 67 years old for those born in 1943 or later. If you choose to start receiving benefits before your FRA, your benefit amount will be reduced. Conversely, if you choose to delay receiving benefits until after your FRA, your benefit amount will be increased.

Additionally, your benefit amount may be further adjusted if you continue to work and earn more than the Social Security earnings limit. If you earn more than the limit, a portion of your benefits may be withheld until you reach your FRA. Once you reach your FRA, your benefits will be recalculated to account for the benefits withheld.

It’s important to note that your Social Security benefit is not the only source of retirement income you should consider. Other sources of retirement income may include pensions, savings, and investments. You may want to consult with a financial advisor to help you plan for retirement and make the most of your retirement income sources.

Does it pay to delay retirement?

Delaying retirement can pay off in several ways, especially when it comes to Social Security retirement benefits. Here are some of the ways delaying retirement can benefit you financially:

- Higher Social Security benefits: If you delay receiving Social Security retirement benefits beyond your full retirement age, your benefit amount will increase by a certain percentage (up to 8% per year for those born in 1943 or later), up to a maximum at age 70. For example, if your full retirement age is 66 and you delay receiving benefits until age 70, your benefit amount will increase by 32%. This can add up to a significant amount over time and provide a higher monthly benefit throughout your retirement.

- More time to save: Delaying retirement can give you more time to save money for retirement, which can be especially helpful if you haven’t saved as much as you would like. By working longer and continuing to save, you can potentially increase your retirement savings and have a more financially secure retirement.

- Health insurance benefits: If you retire before you are eligible for Medicare at age 65, you may need to purchase health insurance on your own, which can be expensive. By delaying retirement, you may be able to continue to receive health insurance benefits through your employer until you are eligible for Medicare.

- Shorter retirement period: Delaying retirement means that you will have a shorter retirement period, which can reduce the amount of time you will need to rely on your retirement savings and Social Security benefits.

Of course, delaying retirement may not be possible or desirable for everyone. Factors such as health, job satisfaction, and family obligations may make it difficult or unappealing to continue working. It’s important to weigh the pros and cons of delaying retirement and make a decision that makes sense for your individual circumstances.

How To Apply For Social Security?

You can apply for Social Security retirement benefits online, by phone, or in person at your local Social Security Administration (SSA) office. Here’s an overview of each option:

- Online: You can apply for Social Security retirement benefits online by visiting the SSA’s website at www.ssa.gov. Before you apply, you will need to create a mySocialSecurity account and provide information about your earnings, work history, and other personal information. Once you submit your application online, you will receive a confirmation number, which you should keep for your records.

- Phone: You can apply for Social Security retirement benefits by calling the SSA’s toll-free number at 1-800-772-1213. The representative who answers the phone will help you complete the application over the phone and answer any questions you may have. You can also schedule an appointment to apply in person at your local SSA office.

- In person: You can apply for Social Security retirement benefits in person at your local SSA office. To apply in person, you will need to bring your Social Security card, a government-issued photo ID, and proof of your age and citizenship or legal residency. You should also bring your most recent W-2 form or tax return to provide information about your earnings.

No matter which method you choose to apply for Social Security retirement benefits, be sure to provide accurate and complete information to ensure that your benefits are calculated correctly. You should also apply for benefits at least three months before you want your benefits to start, as it may take some time to process your application.